Disclaimer: The views and opinions expressed in this article are mine and do not represent those of my employers.

I recently sat down and watched the Oscar-award winning documentary Inside Job which details the events leading up to and after the financial meltdown of 2008. It handles the whole ordeal with the fury of a gentle man, utilizing a surgical precision and ruthless candor that leaves the viewer, burdened with the benefit of hindsight, to exercise everything not to cry indignantly at the screen, “Look! How can you not see it?” Many of the interviewees appeared to be plagued with an intentional blindness towards the blatant, degenerate practices of the financial sector that led to the crisis. This affliction of “intentional blindness” quietly haunted me as I settled into my dreams that night—stained with the familiarity of an old friend, an affair already observed.

Inside Job: An Overview

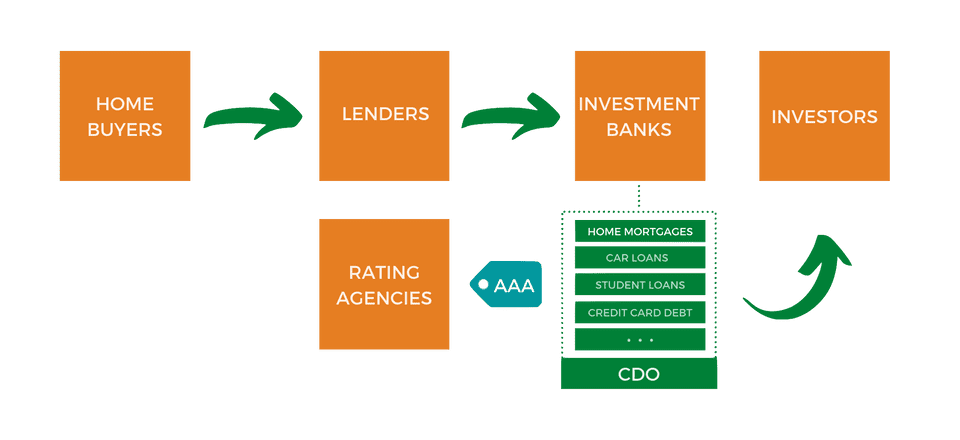

The leading causes to the financial crisis were set into motion by a period of de-regulation starting in the 1980s which fundamentally changed the landscape of the finance industry. By the 2000s, a few giant firms dominated each sector of the industry: five investment banks, two financial conglomerates, three securitized insurance companies, and three rating agencies. All of these entities combined to form the securitization food chain by which “groups of illiquid assets (usually debts) are packaged, bought, securitized and sold to investors.”

Before the establishment of the securitization food chain, lenders would provide mortgage loans out of their own pocket to intending home buyers with the full expectation for that money to be repaid, and since mortgage loans are long-term, lenders were doubly cautious. With the development of securitization, lenders could sell these mortgages to investment banks, taking themselves out of the risk equation if there is a failure to repay. The investment banks then combined thousands of mortgages with other loans to create complex derivatives called Collateralized Debt Obligations, or CDOs, and paid rating agencies to rank these assets before selling them to investors globally. The new system meant that when home owners paid their mortgages, those payments were actually going to investors globally, not back to their local lender, and so the United States housing bubble began to grow.

Lenders quickly realized they were no longer on the hook for risky loans; they could give out sub-prime mortgages to home owners that could never re-compensate but paid higher interest rates in the short term. Investment banks also realized that selling more CDOs, even ones backed by sub-prime loans, meant higher profits, and thus lining their own pockets with large bonuses. They sold troves of these low-value CDOs to investors, lying they were high quality, while simultaneously betting against them through credit default swaps. And finally, credit rating agencies slapped AAA labels, representing the highest possible investment grade and the strongest capacity to repay investors, on many of these low-quality CDOs because they were paid by the investment banks selling them. Credit rating agencies are private companies, whose primary goal is maximizing profit, and has no liability if their rating of CDOs proved wrong—which, spoilers, they did.

The next logical question is, “So…who’s holding the bag?” A question asked by finance industry leaders themselves with a presentation of the same name circulating through inner circles circa May of 2007. It was only a matter of time before home owners given sub-prime mortgages failed to repay, CDOs collapsed, and millions of individuals internationally found out that they were, in fact, the ones holding the bag. Top executives of insolvent companies in the aftermath walked away with their personal fortunes intact and even handed out billions in bonuses following the government bailout.

In Carrots We Trust

I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it.

Charlie Munger

Following the documentary, I wondered why half the participants even agreed to be interviewed, as if they only discovered the repercussions of their corrupt actions during the course of the exchange. They couldn’t have sincerely conceived their exploits to be guiltless…could they? It dawned on me that many of them thought they were plainly pursuing the natural incentives of the system—chasing the carrot. This insight doesn’t absolve their transgressions, but highlight the importance of understanding incentives, making them work for us, as opposed to against us; particularly when applied at the scale of large institutions or entire industries.

Charlie Munger, long-time business partner of Warren Buffet, gave a famous speech on The Psychology of Human Misjudgment in which he urges the audience, “Never, ever, think about something else when you should be thinking about the power of incentives.” Plenty of research has concluded that humans are more complex than incentives can anticipate, but I view Munger’s core sentiment as spotlighting further awareness towards the incentive structures that govern our lives and institutions.

He gives the famous example of FedEx, where they had a rough time getting packages sorted efficiently at a central location each night. The integrity of the entire system depended on the efficacy of this night shift. FedEx eventually realized that paying employees by the hour incentivized them to work longer hours to do the same amount of work, and the problem was promptly solved by paying employees by the shift instead.

Incentives are agnostic of ethics. An individual can become so focused on following the carrot that they forget to look at the path. Of course, you can utilize the power of incentives to bring positive change. For example, I started this newsletter because I wanted to write more, to re-engineer my editorial habits. Want to read more books? Join a book club. Want to get more fit? Buy tickets to Coachella—I mean, a gym membership. Human behavior may be more elaborate than rudimentary conditioning through positive reinforcement, but we are still susceptible to its intoxicating influence.

A Case Of Sour Carrots

At least one person appreciated the power of incentives; who accurately calculated the risks associated with the expansion and de-regulation of the financial sector before the 2008 financial crisis—Raghuram G. Rajan, chief economist of the International Monetary Fund between 2003 and 2006. He published a controversial paper titled Has Financial Development Made the World A Riskier Place? in 2005 that warned about the misalignment of incentives between the investor and the investment. He details that not only have “developments in the financial sector led to the expansion in its ability to spread risks” but investment managers are incentivized to “take risks that are concealed from investors, ones that generate severe adverse consequences with small probability, but, in return, offer generous compensation the rest of the time”, known as tail risks—the easiest to conceal from a world that venerates the bell curve, that great intellectual fraud.

These perverse incentives are littered throughout the securitization food chain like sour carrots, promoting practices that act against the best interest of the customers they serve. Lenders giving out loans that cannot be repaid. Investment managers selling low-quality investments. Credit rating agencies applying fallacious ratings. Each party with their own warped motivation for engaging in self-destructive behavior, blindly chasing carrots further down the rabbit hole.

Have The Carrots Gone Sour?

It is difficult to get a man to understand something when his salary depends upon his not understanding it.

Upton Sinclair

My initial viewing of Inside Job struck a familiar chord with me. Raghuram G. Rajan warned about two alarming symptoms of the financial sector before the crisis: (1) rapid growth without regulation and (2) the misalignment of incentives. I can’t help but feel a strange sense of déjà vu working in technology, as Rajan’s diagnoses appear to predict the challenges that have yet to come for the industry.

The first symptom of “rapid growth without regulation” is an important part of his assessment. In computer science we learn something called Big O, a mathematical notation for asymptotic analysis describing the limiting behavior of a function as the input grows toward infinity. In other words, given a function f(x), Big O notation seeks to describe the growth rate of f(x) as x increases ad infinitum. In this environment, the contribution of terms that grow the most quickly will eventually render the other ones inconsequential. For example, the term with the largest growth rate in the function f(x) = 4x^3 + x^2 + 2 is 4x^3, and thus we can say the Big O of f(x) is O(x^3). Big O describes the limiting behavior of a function at scale, engulfed by the dominating term with the most influence as it grows.

A company may have many factors that guide its trajectory at inception—its mission statement, the company culture, the leadership team’s personal values. However, there is one dominant term that will begin to govern the others as the company grows. Institutions at scale eventually take the form of their primary incentive structures, and in a capitalistic society, this is without a doubt the company’s revenue model.

Many technology companies have chosen an ads-driven revenue model to offer their users a free product, but this is at odds with the user’s best interests. An individual has become reduced to a pair of eyes, they are more valuable to the company staring at a screen than anything else. This is the second symptom that Rajan cautioned of, “the misalignment of incentives”. It reeks of sour carrots when the growth of a product comes at the cost of its users. An aligned business model would ensure that both the company and user would benefit from an improved product.

We’ve already begun to see the ramifications of these symptoms. Maximizing impressions and mining user data for the purposes of ads-exposure are tail risks which generally offer bountiful compensation, but can beget severe consequences with small probability—rampant misinformation leading to a capitol riot, and even the manipulation of a democratic election. However, unlike the events leading up to the 2008 financial crisis, I observe an active awareness and recognition by the international community on this issue. Governments are establishing regulation on data protection and privacy. Companies are standing up third-party committees with authority over their content policies. Leaders in the industry are investing in decentralization, putting power back in the user’s hands.

I can only hope we can sniff out the sour carrots before we fall down the rabbit hole.